Secured Tax Roll

The term "Secured" simply means taxes that are assessed against real property, (e.g., land or structures). The tax is a lien that is "secured" by the land/structure even though no document was officially recorded. This means that if the taxes remain unpaid after a period of 5 years, the property may be sold to cover the taxes owed. Visit the Tax Collector’s website for more information on Secured Property Taxes.

Unsecure Taxes

The term "Unsecured" simply refers to property that can be relocated and is not real estate. The tax is assessed against such things as business equipment, fixtures, boats and airplanes. If the unsecured tax is not paid, a personal lien is filed against the owner, not the property. Visit the Tax Collector’s website for more information on Unsecured Property Taxes.

Supplemental Assessment Roll

The supplemental assessment roll contains a listing of all property that has undergone a change in ownership or experienced new construction. The amount of each supplemental assessment in the difference between the property's new base year value (generally the purchase price), determined as of the date of change in ownership completion of new construction, and the existing assessed tax value. Visit the Tax Collector’s website for more information on Supplemental Property Taxes.

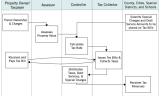

Property Tax Extension

The property tax extension occurs after the roll has been turned over by the Assessor to the Controller and after the County Board of Supervisors has adopted the tax rates for the current year. These tax rates are also applied to the valuation assessed by the State on utility property. The extension of the unsecured roll can be computed as soon as the Assessor has turned the unsecured values to the Controller. This can be done since the tax rate applied is the prior year secured rate.

Tax Roll Changes

These occur when requests are made to the Controller to make a change to the tax rolls. The requests come from the Assessor, Tax Collector, the County Appeals Board and the State Board of Equalization (SBE). In addition, cities and special districts request changes to their special charges. Changes in tax roll result in increase or decrease in the amount of taxes owed and may result in refund to the taxpayer.