For Immediate Release

Redwood City — San Mateo County Controller Juan Raigoza today released for public review the County’s Fiscal Year 2017-18 Comprehensive Annual Financial Report (CAFR) which includes the County’s audited financial statements, management’s analysis, statistics, and other financial information.

The Controller’s Office also released today the County’s Financial Highlights report, otherwise known as the Popular Annual Financial Report (PAFR), which summarizes the details of the County’s financial picture documented in the much longer CAFR. “Since some people may not be interested in reading the comprehensive financial report, we have taken the extra step to prepare a Financial Highlights report every year since 2002 to help the public easily learn about the County’s finances,” Raigoza said.

In addition to presenting the County’s assets and liabilities, both of these documents show how taxpayer monies and other funds are received and spent. “Our goal for these reports is to provide financial information that is easy to understand and transparent to our citizens, taxpayers, residents, policy leaders, and County management,” Raigoza said.

The CAFR is also used by financial institutions and others to assess the County’s financial health. The CAFR’s Letter of Transmittal section provides readers with a summary of the County’s key financial policies, economic and financial outlook, and long-term financial planning.

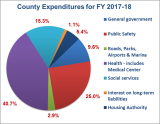

For the fiscal year that ended June 30, 2018, revenues for all County funds totaled $1.9 billion while expenditures totaled $1.6 billion. Three core services comprised 81 percent of total County expenditures: 40.7 percent for health, 25.0 percent for public safety, and 15.3 percent for public assistance services.

Key economic indicators for the County remain positive. The County’s unemployment rate was only 2.1 percent in October 2018, and home prices are at historic highs. However, the pace of economic growth is expected to slow as the current economic cycle matures. Other uncertainties include future federal and state funding priorities that may negatively impact the County’s finances, especially legislation or policies that would reduce payment amounts to the County for providing healthcare services and/or increase the number of uninsured residents.

Planned investments in capital projects will require hundreds of millions of dollars. The County’s exceptional Aaa and AAA bond ratings were recently affirmed by Moody’s Investor Services and S&P Global Ratings. On Nov. 1, 2018, the County sold $217 million in lease revenue bonds to help finance capital improvements. The County’s outstanding credit rating allows it to obtain financing for capital projects at relatively low interest rates.

“These public services and investments, along with economic and legislative uncertainties, will require the County to focus on sustainable growth and closely monitor liabilities and expenditures in order to weather any future revenue reductions and the next cyclical economic slowdown. The current U.S. economic expansion is 9 years old, making it the second longest on record after the 10-year expansion that ended with the bursting of the dot-com bubble in 2001. A recession is inevitable and the County should continue to plan long-term and prepare for it,” Raigoza said.

The CAFR is available at https://controller.smcgov.org/document/2018-cafr and the Financial Highlights report (PAFR) at https://controller.smcgov.org/document/2018-pafr.

###