For Immediate Release

Redwood City — Following last week’s property tax payment deadline, the San Mateo County Controller’s Office is issuing a publication on how properties within the County are taxed, and how monies collected are distributed to local public agencies. In Fiscal Year 2014-2015, $2.1 billion was collected from the One Percent General Tax ($1.7 billion), debt service payments for bonds ($186 million), and special charges ($234 million). “Issuance of the Property Tax Highlights publication illustrates our commitment to transparency by providing taxpayers a clear view into the administration of the property tax process,” said County Controller Juan Raigoza. “Property taxes are a significant contributor to the financial health of our local jurisdictions. This document provides clarity about the complex process from beginning to end. Our residents and taxpayers deserve to know where their money is being used, and we are pleased to give them that information through this publication,” Raigoza said.

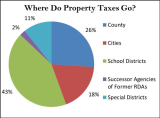

Local government agencies rely on property taxes as a primary source of discretionary revenue. During Fiscal Year 2014-2015, the One-Percent General Tax raised $1.7 billion countywide, of which, 43 percent went to schools, 26 percent to the County, 18 percent to cities, 11 percent to special districts, and 2 percent to successor agencies of former redevelopment agencies. The complete publication is available here. Other County financial information, including the Comprehensive Annual Financial Report issued last week, is available at www.smcgov.org/controller.